Weekly Financial News: 1st Week February 2024

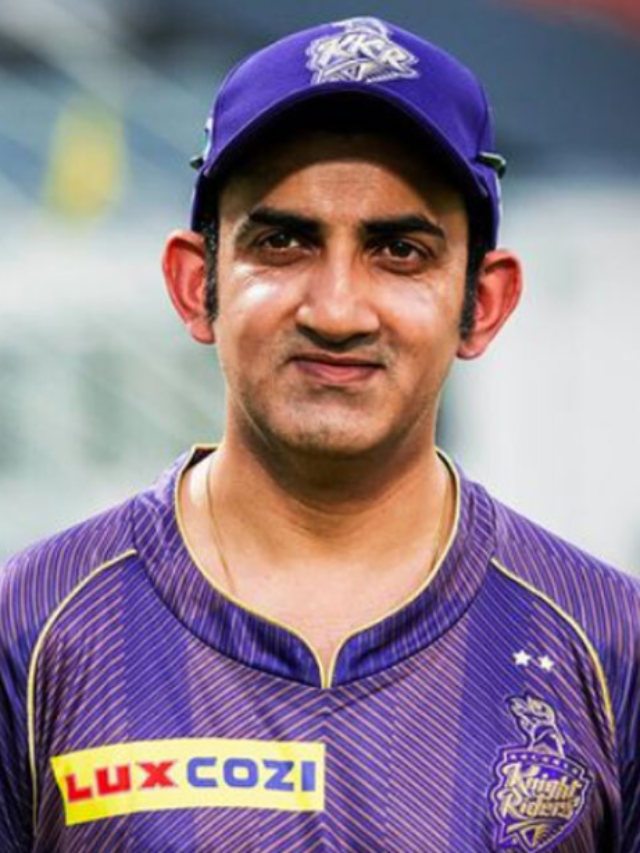

1. IRDAI brings AYUSH treatment under health insurance cover from April 1.

- Insurance regulator the Insurance Regulatory and Development Authority of India (IRDAI) has issued directions to all insurance companies telling them to cover AYUSH treatment just as other treatments.

- AYUSH refers to the treatment given under alternative therapies of Ayurveda, Yoga, Unani, Siddha and Homeopathy.

Circular Guidelines

- Insurance companies are mandated to establish board-approved policies for AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) coverage, aligning them with other treatments for health insurance.

- These policies must include approaches to equalize AYUSH treatments with other forms of treatment, providing policyholders the choice of treatment.

- Quality parameters and procedures for enrolling AYUSH hospitals/day care centers as network providers for offering cashless facilities are also to be included in these policies.

Insurers will have adequate controls as well as standard operating procedures for a number of activities which include the following:

- Enrolling hospitals into their network.

- Placing necessary clauses in their health services agreements with Ayush hospitals/ day care centres.

- Standard treatment protocols, and

- Dealing with the possible frauds and abuse of the system, if any

For this purpose, the Ministry of Ayush on Oct 4, 2023 constituted a ‘Core Group of Experts for Insurance Sector’ under the chairmanship of Bejon Kumar Misra, International Consumer Policy Expert.

- The directions issued on Jan 31 will come into effect from April 1, 2024.

- The circular was issued in terms of Section 14(2) (b) of IRDA Act 1999.

Important note:

- Current Chairman of IRDAI: Debasish Panda

- Headquarters of IRDAI: Hyderabad, Telangana

2. RBI’s Digital Payments Index Rises in September 2023

- The Reserve Bank of India’s (RBI) Digital Payments Index increased to 418.77 in September 2023 from 395.57 in March 2023.

- Digital payments across India grew by 10.94% in a year through March 2023, according to RBI’s Digital Payments Index (RBI-DPI).

- The increase in the RBI-DPI index was driven by growth in payment enablers, payment performance, and consumer centricity across the country.

About DPI:

- The RBI-DPI has been constructed with March 2018 as the base period, setting the DPI score for March 2018 at 100.

- In September 2019, the index stood at 173.49, rising to 217.74 in September 2020, and to 304.06 in September 2021.

Parameters of RBI-DPI

The Digital Payments Index (DPI) measures the extent of digitalization in payments at a national level and provides insights into the advancement of various digital payment methods. It is published twice a year and comprises five primary parameters, each carrying different weights:

- Payment Enablers (25%),

- Payment Infrastructure – Demand-side factors (10%)

- Payment Infrastructure – Supply-side factors (15%)

- Payment Performance (45%), and

- Consumer Centricity (5%)

3. India’s UPI launched in France

- India’s UPI service is now operational at the Eiffel Tower in Paris, France.

- NPCI International Payments (NIPL), the international arm of NPCI partnered with French e-commerce and proximity payments company Lyra Network, to facilitate the acceptance of UPI payments in Europe.

- Eiffel Tower is the first merchant to offer UPI payments in France.

About UPI

- Unified Payments Interface is an Indian instant payment system developed in 2016 by the National Payments Corporation of India (NPCI).

- It integrates multiple bank accounts into a single mobile app of any participating bank.

4. ESAF Small Finance Bank joins with Edelweiss Tokio Life to offer life insurance products

- Kochi-based ESAF Small Finance Bank partnered with Edelweiss Tokio Life Insurance

- Bancassurance partnership aims to reach unbanked and underbanked populations.

- Kochi-based ESAF Small Finance Bank announced a bancassurance partnership with Edelweiss Tokio Life Insurance.

- Bancassurance is an arrangement between a bank and an insurance company allowing the latter to sell its products to the bank’s client base.

- MD and CEO of ESAF SFB: K Paul Thomas

5. RBI Revised the eligibility norm for UCBs inclusion in 2nd Schedule of RBI Act 1934

- The RBI has recently introduced revised eligibility norms for the inclusion of Urban Co-operative Banks (UCBs) in the Second Schedule of the RBI Act, 1934.

- This significant move, following the release of the Revised Regulatory Framework for UCBs in July 2022, aims to bolster the financial stability and governance of cooperative banks in India.

Revised Eligibility Norms:

- Aligning with Regulatory Framework The revised norms aim to address these challenges by aligning with the principles of the Revised Regulatory Framework. Key changes include:

(i) Focus on Capital Adequacy: UCBs must maintain a Capital to Risk-Weighted Assets Ratio (CRAR) of at least 3% above the minimum requirement applicable to their tier, ensuring stronger capital buffers and resilience against risks.

(ii) Addressing Regulatory Concerns: Inclusion is contingent upon UCBs having no major regulatory and supervisory concerns identified by the RBI, emphasizing sound governance and compliance practices.

(iii) Tier-Specific Approach: The notification dated September 4, 2023, specifies that only licensed Tier 3 and Tier 4 UCBs meeting the criteria are eligible for inclusion. This prioritizes smaller banks’ inclusion while maintaining prudential standards.

What is the Significance of the Second Schedule?

- The Second Schedule of the RBI Act enlists scheduled banks, granting them direct supervision by the central bank. Inclusion in this list offers UCBs access to various privileges, enhancing their credibility and competitiveness in the banking sector. These privileges include:

- Borrowing directly from the RBI

- Issuing drafts and letters of credit

- Participating in clearing house arrangements, and

- Undertaking foreign exchange transactions.

6. Government Allocates Rs 9,000 Crore to Exim Bank Due to Non-Performing Loans Granted to Foreign Nations

- Exim Bank of India has extended loans to some African countries, which have turned into non-performing assets (NPAs).

- The Ministry of External Affairs has provided Rs 9,013.72 crore to Exim Bank after the loans were classified as “doubtful debt” in 2023-24.

- These loans are given to countries in Asia (excluding Bangladesh, Nepal, Bhutan), Africa, Commonwealth of Independent States, and Latin American regions under the Indian Development and Economic Assistance Scheme.

- When guarantees are invoked by a financial institution, the funds are paid out of the Guarantee Redemption Fund established in the Public Account of India since 1999-2000.

- An additional Rs 4,383.40 crore was provided in 2024-25 towards payment to Exim Bank for guarantees that may be invoked against doubtful debts in the future.

7. SBI partners with Flywire Corporation for Indian students international education payment

- State Bank of India (SBI) has partnered with Flywire Corporation to facilitate international education payments for Indian students.

- The partnership integrates Flywire technology into SBI’s platform, offering students a seamless digital checkout experience in Indian rupees within the bank’s net banking platform.

- Services include covering various fees from applications to tuition, enabling students to make transactions easily in just three steps.

- Indian students can now pay education fees to higher education institutions across the world in Indian Rupees (INR) directly from their SBI Accounts.

- This facility is in line with the compliance process of the Liberalized Remittance Scheme (LRS) guidelines set by the RBI.

- LRS guidelines allows Indian students to easily remit upto USD 250,000 per financial year (FY).

8. HDFC Bank unveils four SME-focused credit cards

- HDFC Bank has introduced a new series of credit cards targeting entrepreneurs, freelancers, and professionals in the SME sector.

- The range includes four variants: BizFirst, BizGrow, BizPower, and BizBlack.

- All cards within the range will provide 55 days of interest-free credit, which is the highest number of days offered by any bank at present.

- Besides, these SME-focused credit cards offer savings on essential business expenses, like utility bills, GST, income tax, vendor payments, business travel, and business productivity tools.

5 key features of the business credit cards

- Up to 55 days of interest-free credit period claimed to be the highest in the industry

- Up to 10X Reward Points on business spends

- Coverage for various business risks through a specially curated business insurance package

- Exclusive redemption options in a business-focused catalogue

- EMI and loan on card facility for added financial flexibility.

Note: On January 24, 2024, HDFC Bank achieved the milestone of having two crore credit cards in force, making it the first lender to do so. As of March 2023, HDFC Bank holds a market share of 28.6 percent, making it the largest credit card issuer in India.

Thanks

Never Stop Learning!